Unlocking Small Business Potential: The Power of QuickBooks for Streamlined Accounting

- Rita McDaniel

- Oct 4, 2024

- 4 min read

In today's fast-paced business world, small business owners often find themselves juggling multiple responsibilities. With limited time and resources, streamlined operations can mean the difference between thriving and struggling. QuickBooks, a leading accounting software, can transform your approach to finances, making it simpler, faster, and less stressful. This post highlights how QuickBooks can be the ultimate solution for maximizing efficiency in your accounting practices.

What is QuickBooks?

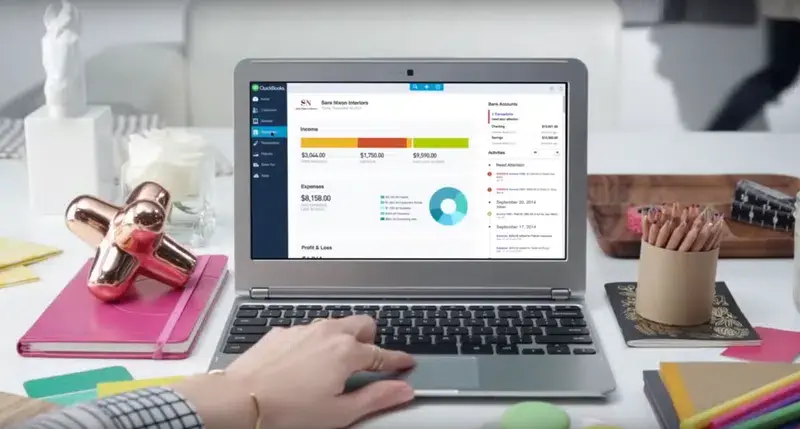

QuickBooks is a powerful accounting software specifically tailored for small businesses. It simplifies a variety of financial tasks, including tracking income and expenses, invoicing customers, and managing payroll. Available on desktop and cloud-based platforms, QuickBooks offers flexibility and convenience to users across different devices.

The intuitive interface makes navigation easy, even for entrepreneurs lacking extensive accounting knowledge. For example, users can set up their accounts in under an hour and start processing financial transactions immediately.

The Importance of Efficient Accounting

Efficient accounting is essential for small businesses. It not only ensures accurate financial reporting but also supports informed decision-making and compliance with legal and tax obligations. According to a study, 30% of small business owners experience cash flow issues due to poor accounting practices, which can jeopardize their sustainability.

Automating your financial processes with QuickBooks helps save time and minimizes human errors. Studies show that businesses using accounting software can reduce time spent on bookkeeping by up to 40%, allowing owners to focus their efforts on growing core operations.

Automating Routine Tasks

One of QuickBooks' standout features is its ability to automate routine tasks. You can automate actions like invoicing, payment reminders, and expense tracking. This automation reduces the need for manual data entry, which minimizes mistakes, ensuring you stay organized without the tedious work.

For instance, when a customer pays an invoice, QuickBooks promptly updates your records and can even send a thank-you note automatically. This means you improve efficiency while enhancing customer satisfaction through timely communication.

Real-Time Financial Reporting

QuickBooks excels in providing real-time financial reporting, which is crucial for making swift business decisions. Instant access to reports on profits, losses, and cash flow enables you to grasp your business’s financial health quickly.

This feature is particularly invaluable during meetings with investors or stakeholders. Having accurate data ready to present can significantly impact perceptions of your business. According to a survey, businesses that utilize financial reports are 45% more likely to see revenue growth.

Expense Tracking Made Easy

Understanding where money is spent is vital for small business owners. QuickBooks streamlines this tracking by connecting directly to bank accounts and credit cards. Transactions automatically import and categorize, making it easier to uncover spending patterns and potential savings.

Plus, capturing receipts and attaching them to transactions within QuickBooks ensures you have a clear record come tax season. This can decrease preparation time by approximately 50%, reducing stress when filing taxes.

Invoicing and Payments Simplified

Generating and sending invoices can often be tedious. QuickBooks changes that with a streamlined invoicing process. You can create professional-looking invoices in minutes, customizable to reflect your brand's voice.

Additionally, QuickBooks allows customers to pay online directly through the invoice. This feature can cut the time it takes to receive payments by 20%, allowing you to maintain a healthy cash flow without the hassle of following up on overdue payments.

Payroll Management without the Headache

Managing payroll is one of the more complicated aspects of small business accounting. QuickBooks simplifies this process by automating calculations for salaries, taxes, and deductions.

With QuickBooks, running payroll takes just a few clicks, ensuring that employees get paid correctly and on time. This not only alleviates administrative burdens but also fosters employee satisfaction, as studies show timely payroll significantly boosts morale.

Tax Management Made Simple

Tax preparation can feel overwhelming for small business owners. QuickBooks offers various tools to simplify tax management. By automatically tracking expenses and income throughout the year, it makes the tax preparation process straightforward.

For instance, QuickBooks can generate detailed tax reports that clarify your tax liability and identify potential deductions. Organized records can lead to savings of up to 15%, reflecting substantial benefits for businesses.

Collaboration with Accountants

Working with accountants or financial advisors is crucial for any small business. QuickBooks enhances this collaboration by allowing accountants to access your financial data in real time. This transparency reduces the back-and-forth that often complicates accounting practices.

Whether you are employing a full-time accountant or outsourcing services, QuickBooks facilitates better communication and keeps everyone aligned regarding your financial status.

Embracing Efficiency with QuickBooks

Time is invaluable for small businesses. QuickBooks offers a comprehensive solution designed to meet their unique accounting challenges. By automating tedious tasks, supplying real-time financial data, easing expense tracking, and simplifying invoicing and payroll management, QuickBooks can be a game-changer for your business operations.

Investing in QuickBooks is not just about selecting accounting software; it's an empowering step toward smoother business operations. Take charge of your accounting and allow yourself the freedom to focus on what matters most—growing your business. Unlock your small business potential and streamline your accounting with QuickBooks today.

Comments