Mastering Financial Management: Harnessing the Chart of Accounts in QuickBooks

- Rita McDaniel

- Jun 14, 2024

- 3 min read

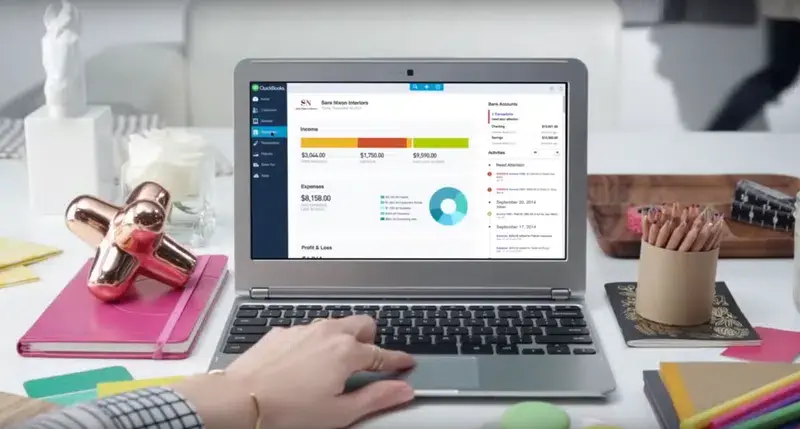

QuickBooks stands as a cornerstone, offering robust tools and features to streamline financial management processes. Central to its functionality is the chart of accounts, a critical component that lays the groundwork for accurate record-keeping and reporting. Building upon our previous discussion, let's delve deeper into how to leverage the chart of accounts effectively within QuickBooks.

Navigating the Chart of Accounts in QuickBooks

Accessing the Chart of Accounts: In QuickBooks, the chart of accounts can be accessed from the "Lists" menu. From here, you can view, edit, and manage your accounts to reflect the unique financial structure of your business.

Adding Accounts: QuickBooks allows users to customize their chart of accounts to suit their specific needs. You can add new accounts by selecting the appropriate account type and providing relevant details such as account name, description, and account number.

Organizing and Categorizing: Proper organization is key to a well-functioning chart of accounts. QuickBooks offers the flexibility to group accounts into categories and subcategories, making it easier to track and analyze financial data. You can organize accounts by type, such as assets, liabilities, equity, income, and expenses, as well as create custom categories tailored to your business.

Assigning Account Codes: Each account in QuickBooks is assigned a unique account code or number for easy identification and reference. When coding transactions, simply select the appropriate account from the chart of accounts and enter the corresponding account code to ensure accuracy and consistency.

Integration with Transactions: QuickBooks seamlessly integrates the chart of accounts with transaction entry, allowing you to assign accounts directly when recording transactions such as invoices, payments, and expenses. This simplifies the coding process and ensures that transactions are accurately categorized for reporting purposes.

Maximizing Reporting and Analysis Capabilities

Financial Reporting: QuickBooks leverages the chart of accounts to generate a wide range of financial reports, including balance sheets, income statements, and cash flow statements. By maintaining a well-organized chart of accounts, businesses can access timely and accurate financial information to monitor performance and make informed decisions.

Budgeting and Forecasting: The chart of accounts serves as the foundation for budgeting and forecasting in QuickBooks. By aligning budget categories with specific accounts, businesses can create comprehensive budgets and projections to guide financial planning and resource allocation.

Tax Preparation: QuickBooks simplifies tax preparation by leveraging the chart of accounts to categorize transactions according to tax codes and requirements. This streamlines the process of generating tax reports and ensures compliance with regulatory obligations.

Best Practices for Chart of Accounts Management

Regular Review and Maintenance: Periodically review and update your chart of accounts to reflect changes in your business operations or financial structure. This ensures that your accounting records remain accurate and up-to-date.

Consistency and Standardization: Maintain consistency in account naming conventions and coding practices to facilitate uniformity across your financial records. This enhances clarity and reduces the risk of errors or discrepancies.

Training and Education: Invest in training and education for yourself and your team to ensure proficiency in using QuickBooks and optimizing its features, including the chart of accounts.

By harnessing the power of the chart of accounts within QuickBooks, businesses can streamline financial management processes, gain valuable insights into their financial performance, and drive informed decision-making. With the right tools and practices in place, mastering financial management becomes not only achievable but also transformative for small businesses striving for growth and success.

Comments