QuickBooks Online vs. QuickBooks Desktop

- Rita McDaniel

- Mar 22, 2024

- 3 min read

Updated: Apr 12, 2024

With more than two decades of experience supporting the small business community, I've assisted numerous businesses in transitioning between QuickBooks Desktop and QuickBooks Online. In the dynamic realm of business management and accounting, selecting the appropriate software is paramount for achieving success. QuickBooks, a highly regarded accounting software, presents two main alternatives: QuickBooks Online (QBO) and QuickBooks Desktop. Both options come with distinctive features, benefits, and limitations. In this blog post, we will delve into the advantages and disadvantages of both QuickBooks Online and QuickBooks Desktop, aiming to provide insights that will empower you to make an informed decision for your business.

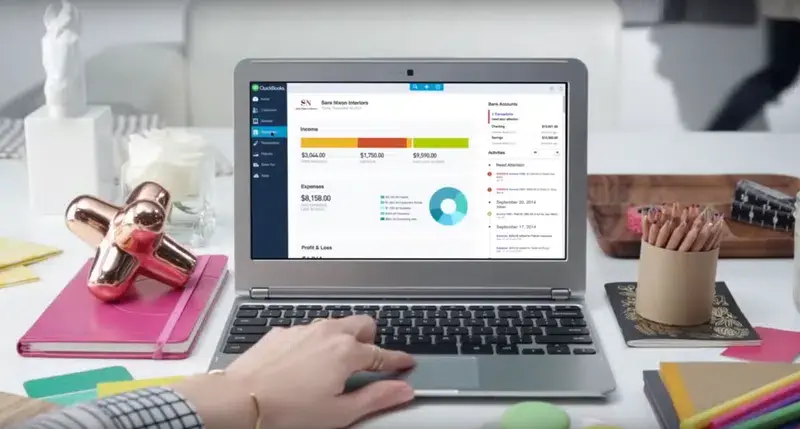

QuickBooks Online:

Pros:

1. Accessibility and Flexibility:

QuickBooks Online provides the flexibility of accessing your financial data from any device with an internet connection. This is particularly beneficial for businesses with remote teams or on-the-go entrepreneurs.

2. Automatic Updates:

QBO is cloud-based, ensuring automatic updates without requiring manual installations. This feature ensures that users always have access to the latest features and security patches.

3. Collaboration:

The online platform allows multiple users to collaborate in real-time, making it easier for teams to work together on financial tasks and reducing the risk of data discrepancies.

4. Integration with Third-Party Apps:

QuickBooks Online seamlessly integrates with a variety of third-party applications, enabling businesses to customize their accounting solution according to their specific needs.

5. Automatic Backups:

With QBO, your financial data is securely stored in the cloud, providing automatic backups. This is a valuable feature for preventing data loss due to unforeseen circumstances.

Cons:

1. Monthly Subscription Costs:

QuickBooks Online operates on a subscription-based model, which means ongoing monthly costs. This can be a drawback for smaller businesses with tight budgets.

2. Limited Functionality:

While QBO offers a range of features, it may not be as robust as the desktop version in terms of advanced reporting and industry-specific capabilities.

QuickBooks Desktop:

Pros:

1. One-Time Purchase:

QuickBooks Desktop operates on a one-time purchase model, making it a cost-effective solution for businesses that prefer a traditional software licensing approach.

2. Advanced Functionality:

The desktop version often provides more advanced features and industry-specific tools, making it a preferred choice for businesses with complex accounting needs.

3. Data Control:

Some users appreciate the control they have over their data when using QuickBooks Desktop, as it is stored locally rather than in the cloud.

4. Offline Access:

Unlike QuickBooks Online, the desktop version does not rely on an internet connection for day-to-day operations, making it suitable for businesses in areas with unreliable internet access.

Cons:

1. Limited Accessibility:

QuickBooks Desktop restricts users to a single device, which may hinder collaboration for businesses with remote teams or those that require on-the-go access.

2. Manual Updates:

Unlike QuickBooks Online, the desktop version requires manual updates. Failure to keep the software up-to-date can result in missing out on essential features and security patches.

The decision between QuickBooks Online and QuickBooks Desktop hinges on your business's specific requirements, preferences, and budget limitations. QuickBooks Online excels in accessibility and collaboration, while QuickBooks Desktop stands out for advanced functionality and cost-effectiveness. Thoroughly assess your business needs and weigh the advantages and disadvantages mentioned above to arrive at an informed decision that aligns with your financial management objectives.

A crucial piece of advice is to seek professional guidance if you opt to switch from one software to another. Consulting with a professional ensures a smoother transition, minimizing the risk of overlooking critical information during the transfer process. Their expertise can be invaluable in navigating potential challenges and optimizing the use of your chosen accounting software.

Comments